How disruptive technologies are changing an entire sector

For companies and investors alike, the innovation potential of the biotech sector over the past two years has been dominated by the development of vaccines and therapies against covid-19. This emphasis is now increasingly diminishing. At the same time, the financial markets are focusing more on chronic and severe diseases that affect a larger proportion of the population. Important technological advances, [...]

Moderna's next vaccines soon ready

At Moderna, the results for the Omikron-specific booster vaccine and the mRNA-1010 influenza vaccine are probably the most important events for 2022. A new generation of these mRNA vaccines is expected to be superior to conventional influenza vaccines in terms of efficacy profile and efficiency by including additional antigens and virus strains in addition to the four selected by the WHO. If a combination vaccine against influenza and coronaviruses can be brought to market, the global market for flu vaccines, which currently accounts for around 500 million doses annually, could expand significantly, possibly even doubling. Combination vaccines also appeal to people who are skeptical about regular single vaccinations. Because of the fast development times and good tolerability of mRNA vaccines, their protagonists Moderna, Biontech and Pfizer would be the big winners of such a breakthrough. Because industry experts estimate the prices for such combination vaccines at up to USD 60 per dose, this opens up enormous sales potential. In Moderna's long-term plans, the efficacy of mRNA technology in influenza is only an intermediate step. Currently, Moderna has three important Phase III trials underway. In addition to the flu vaccine, they are a vaccine against RSV, a serious respiratory infection in infants and young children, and a vaccine against cytomegalovirus (CMV). Currently, there are no treatment options against this herpes virus, which can cause deafness and developmental disorders in newborns.Genome editing - technology for billion-dollar sales

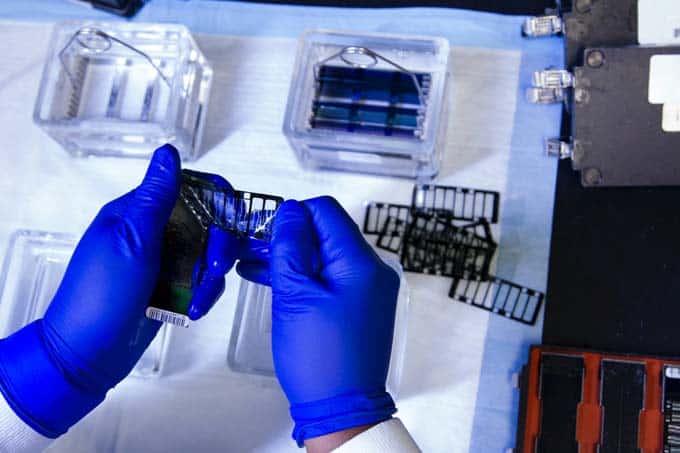

Genome editing, which aims to permanently cure diseases, is on the verge of a major commercial breakthrough. This involves excising fragments of human DNA thought to be genetic triggers of disease and repairing them with genetic replacements. Crispr Therapeutics, in collaboration with Vertex Pharma, is developing therapies for beta-thalassemia and sickle cell disease. There are currently no adequate treatment options for these two genetic disorders in the formation of blood cells that cause severe disease progression. Due to a specific genetic predisposition, the severe form of sickle cell anemia is dominant in the United States, with approximately 50,000 patients. Beta-thalassemia, also known as Mediterranean anemia, on the other hand, is more common in southern Europe, while its severe form occurs in about 1,000 patients in the United States. This therapy is a complete cure after a single dose. The market approval of the first drug based on genome editing would revolutionize the treatment of this disease. Accordingly, the pricing power for this product, which only needs to be administered once, is great. In the second half of 2022, Crispr and Vertex Pharma will be the first companies to submit regulatory data and a regulatory filing. If, as expected, the product makes it to market in 2023, it could generate peak annual sales in the billions. As genetic engineering techniques for drug development, RNA-based therapeutics such as siRNA and ASO (antisense oligonucleotides) have received market approval in niche indications in recent years. Alnylam is a leader in siRNA-based drugs and should report clinical results for its already approved product, Onpattro, by mid-year. If successful, the application would expand from 50,000 patients with ATTR amyloidosis and polyneuropathy to date to up to 300,000 more patients with ATTR cardiomyopathy. ATTR is a rare disease in which a certain protein is not broken down in the body and is deposited in organs.Artificial intelligence creates new foundations

Rational drug design is a novel approach that uses artificial intelligence (AI) and machine learning to analyze the molecular movements of protein molecules for their role in disease development. The company, Relay Therapeutics, has three cancer drugs in Phase I clinical trials that target disease-causing proteins that were previously not considered accessible targets for therapies. Black Diamond Therapeutics uses machine learning techniques for cancer therapies that work independently of specific tumor types. Thanks to its pioneering role in numerous disruptive technologies, the biotech industry could soon attract investor interest again. The numbers speak for themselves. While an average of 20 drugs were approved annually in the USA, the world's largest drug market, at the beginning of the noughties, this figure has risen to 58 in 2021. At the same time, in purely quantitative terms, the total number of clinical trials and the patients treated in them is significantly higher than before the pandemic began. The importance of biotechnologically produced drugs will continue to grow in the future. It is estimated that biotech products will account for around 40% of total prescription and over-the-counter drug sales by 2026. Author: Dr. Daniel Koller joined Bellevue Asset Management in 2004 and since 2010 has been Head Investment Management Team of the BB Biotech AG, an investment company based in Schaffhausen/Switzerland. From 2001-2004 Daniel Koller was an investment manager at equity4life Asset Management AG and from 2000-2001 an equity analyst at UBS Warburg. He graduated in Biochemistry from the Swiss Federal Institute of Technology (ETH) Zurich and holds a PhD in Biotechnology from ETH and Cytos Biotechnology AG, Zurich. Editor's note: BB Biotech AG holds shares in some of the companies mentioned in the text or has them in its portfolio.This article originally appeared on m-q.ch - https://www.m-q.ch/de/wie-disruptive-technologien-einen-ganzen-sektor-veraendern/