Study by Havas identifies top CX trends

The X Index is a proprietary research tool that identifies the most important factors of a customer experience and makes them measurable. For the global study, 54,000 people worldwide were surveyed to measure the CX performance of 500 well-known brands from the e-commerce, insurance, travel, hospitality, beauty, health, retail and specialty retail, banking, fashion, sports, finance, telecommunications, home, and leisure [...]

The X Index is a proprietary research tool that identifies the most important factors of a customer experience and makes them measurable. For the global study, 54,000 people worldwide were surveyed to assess the CX performance of 500 well-known brands from the e-commerce, insurance, travel, hospitality, beauty, health, retail and specialty retail, banking, fashion, sports, finance, telecommunications, home, and leisure and entertainment sectors.

The X Index is a proprietary research tool that identifies the most important factors of a customer experience and makes them measurable. For the global study, 54,000 people worldwide were surveyed to assess the CX performance of 500 well-known brands from the e-commerce, insurance, travel, hospitality, beauty, health, retail and specialty retail, banking, fashion, sports, finance, telecommunications, home, and leisure and entertainment sectors.

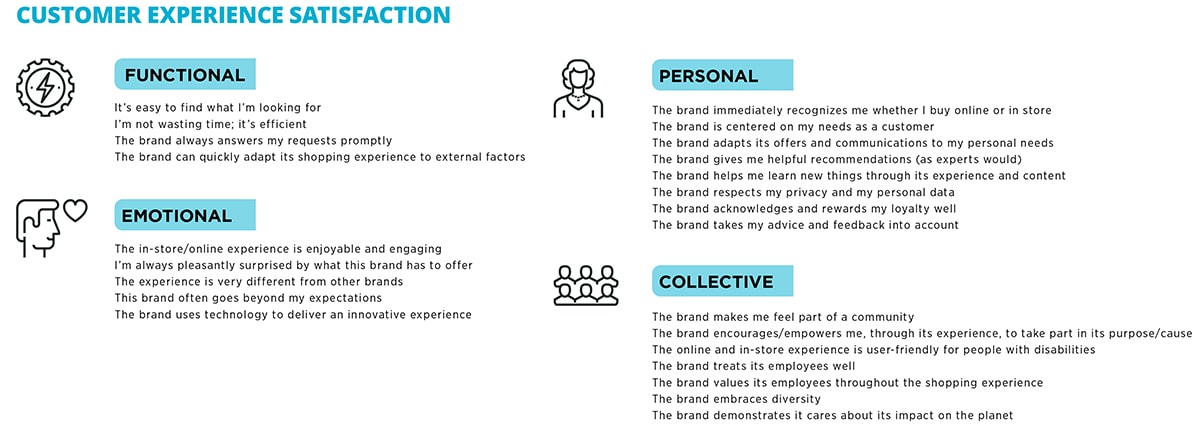

Using 24 evaluation aspects that include emotional, functional, personal, and collective factors, the full range of the customer journey was examined to measure what creates a compelling customer experience.

The study examined the customer experiences of so-called "bricks and clicks" brands - companies that operate brick-and-mortar stores in addition to their online business - and of pure Internet companies, the "pure players. The X Index also included a scorecard on which the respondents rated how well the brands fulfill the various touchpoints with customers throughout the entire customer journey - from social media to customer service.

When is the CX convincing - and when is it not?

Whereas in Italy (47%) and France (45%), for example, it is primarily the functional aspects of the customer experience that are decisive, in Germany it is the emotional criteria (48%) that are decisive in determining whether an experience is rated as good. Emotional criteria such as a stand-out, entertaining experience with the product itself or innovative and surprising touchpoints along the customer journey. The brands that perform well in Germany, such as Apple or Adidas, are also characterized by the fact that they focus on their customers across all touchpoints (7.3 out of 10), for example through a customer-centric design, a reliable customer care offering, or the appreciative handling of customer feedback.

Another factor that makes brands stand out is the provision of efficiency-enhancing functions that save customers time (7.3 out of 10) or make it easier to find the right product or the right answer (7.5 out of 10). Among the top-rated brands with the highest recommendation rate are predominantly "pure players" such as PayPal, Airbnb or Booking.com.

This contrasts with failures on the part of almost exclusively "bricks & clicks" companies: According to the study results, it is the retail companies, as well as banks and telecommunications service providers, which have so far offered inadequate CX performance. The hallmarks of this performance are that customers are left out in the cold due to a lack of feedback systems or loyalty programs, for example, and a lack of inspiration in the form of relevant recommendations, helpful tips and innovative experiences. Particularly in the retail sector, there are significant deductions when it comes to offering a community feeling or promoting loyalty through a reward system.

CX in turbulent times

The study shows that consumers are not very willing to compromise on their brand decisions in times of economic tension. In the analysis of the study results, three concrete recommendations for action emerge for brands to improve their own CX for consumers.

Recommendation for action 1: Focus on efficiency and care

Especially for "pure players" and the e-commerce area of hybrids, it is important to offer an efficient experience through intuitive navigation or time-saving tools and service processes. Offline, the emphasis is on the personal and in-store experience, from which consumers expect that it is entertaining and varied, or that the spatial and personal circumstances are used for an appealing presentation. It is essential for both areas to show appreciation - by rewarding loyalty or responding to feedback. Customers want to feel seen, appreciated and respected as individuals by brands in contact.

Recommendation for action 2: Balance between personalization and privacy

In the era of algorithms, the expectation of a personalized experience in brand contact is increasing. The privacy-compliant use of data can help brands offer their customers an innovative and surprising experience, for example through inspiring recommendations and profile-based predictions or interest-based content. However, customers expect brands to unconditionally protect their personal data.

Recommendation for action 3: Community Experience through Inspiration and Attitude

Consumers want brands to inspire them to participate in a cause through their actions, and they value brands' commitment to diversity or the environment. For brands, this means making their customer experience also a community experience by showing an attitude that motivates participation and by adapting their offers and communication to the personal needs of customers.

This expectation includes ensuring accessibility for people with limitations and disabilities, both online and offline, in order to give all consumers equal access to what is on offer.

"Today's consumers expect brands to deliver a perfect experience both off and online. In an era of oversupply and service-driven algorithms, brands that want their CX to stand out must go beyond first-class service," explains Sandra Onofri, Chief Strategy Officer at Havas Germany. "It will be the brands that succeed in creating exceptional moments and interactions that recognize, understand and reward customers in their individuality that will prevail with consumers."

The Havas X Index Study was developed in 2018 in collaboration with research institute OpinionWay and serves as a global barometer for measuring and optimizing customer experiences. In 2023, Havas deployed the X Index study in ten countries - Germany, China, France, India, the UK, the US, Brazil, Turkey, Portugal and Spain - and surveyed 54,000 adults on more than 500 brands. These included well-known "bricks & clicks" (brands with brick-and-mortar stores that have undergone digital transformation) and "pure players" (online-only players) brands from a wide range of industries: from leisure and retail to transportation, technology and finance.

The free white paper on the study can be here be requested.