These are the top brands in the retail and consumer goods industry in 2022

At the beginning of February 2023, Werbewoche.ch reported on trends and developments in the brand and advertising performance of brands from the financial and insurance sectors in 2022, based on a study by the market research institute Link. Now come selected highlights on 100 brands from the retail and consumer goods industry. The basis for this is provided by around 13,000 online interviews per brand and year. Expansion of XXXLutz [...]

At the beginning of February 2023 reported Advertisingweek.ch based on a study by the Link market research institute on trends and developments in the brand and advertising performance of brands from the financial and insurance sector in 2022. Selected highlights on 100 brands from the retail and consumer goods industry now follow. Around 13,000 online interviews per brand and year provide the basis for this.

Expansion of XXXLutz does not (yet) lead to more satisfied customers

In general, it can be said that the retailers Migros and Coop not only lead the awareness ranking. In other categories such as special trustworthiness, consideration, offline and digital advertising and media perception, the two brands are also in a neck-and-neck race, with Migros always slightly ahead of Coop in first place.

In addition, a lot has happened in 2022, particularly in the Swiss furniture sector, which is clearly reflected in the results. A notable absolute increase in awareness in 2022 was recorded by the Austrian furniture retailer XXXLutz (+5.1 percentage points), which is hardly surprising given that the company is on an expansion course and at the beginning of 2022 the Swiss furniture chain Lipo acquired and had opened a second branch in Dietikon ZH in August.

What is striking here is that customer satisfaction is not yet on an expansion course at XXXLutz. With 19 percent, the furniture store occupies one of the lowest ranks in average, special customer satisfaction - among its direct competitors, only the furniture store Conforama, which has was taken over by XXXLutz, of all companies, at the beginning of 2023, a lower value (16 percent). Customer satisfaction at XXXLutz has also been trending downward since September 2021.

When looking at the increase in "Consideration" - the probability of being a customer (again) in the future - it is striking that the two furniture stores Livique and Jumbo 2022 were able to position themselves particularly positively with an increase of 5.2 percentage points each.

Brand Children in the Media Spotlight

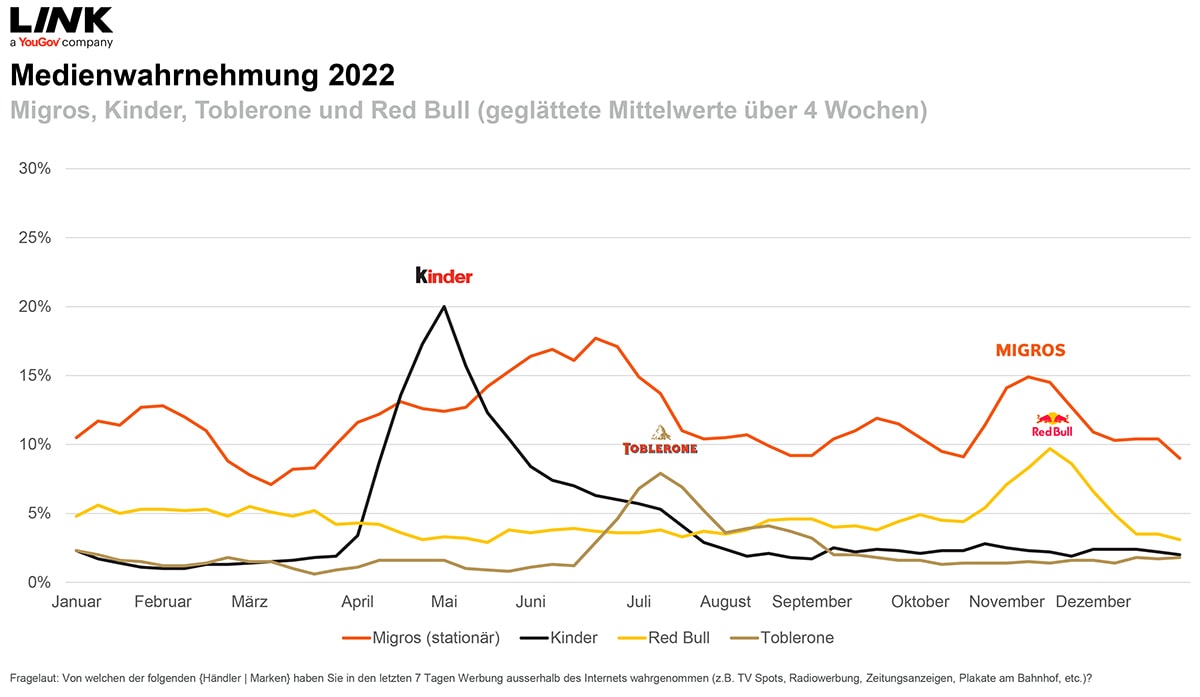

The media perception figures reflect society's reaction to the latest news about various brands - this is particularly evident in 2022 with the Kinder brand as an example. Starting in mid-April, the perceived media reports among consumers increased significantly and peaked in mid-May. This is likely to be related to the Salmonella infections in European factories of the manufacturer Ferrero were reported at the time. Also a possible result of this reporting is the lower consideration of the Kinder brand over the year as a whole (-4.1 percentage points), which fell particularly sharply over the period from April to May.

Toblerone also had a conspicuous peak in media perception when it became known in June that part of their production moved from Bern to Slovakia is being made. As a result, the brand suffered persistently in terms of various key figures - including brand trust, perceived Swissness, quality perception and willingness to buy more - and was only able to recover somewhat in some areas. By June, for example, around 40 percent of the Swiss population had a particularly high level of brand trust in Toblerone; in July, it was still around 32 percent. Towards the end of the year, this rose again, but is still slightly below the values before the announcement.

Coop acquisition strengthens Jumbo brand

At the end of August 2022, it became public that the Jumbo DIY stores, which have been owned by Coop since 2021, would be merged with the own brand Bau+Hobby and the Branches to be continued under the Jumbo brand. The available data clearly shows that this has led to a strengthening of the Jumbo brand among consumers: for example, Jumbo 2022 recorded a consideration increase of 5 percentage points, a trust increase of 4.5 percentage points and a satisfaction increase of 4.6 percentage points.

Lindt and Zweifel dominate the majority readiness

Finally, in terms of willingness to pay more, Lindt and Zweifel are clear high performers, which are also at the absolute top outside the retail and consumer goods industries. In 2022, more than 20 percent of the population were willing to pay more for products from the two brands Lindt and Zweifel than for comparable products from other brands.

The two brands thus stand out in particular from the other retail and FMCG brands surveyed, all of which failed to achieve figures above 20 percent throughout the year. Ovaltine was the only FMCG brand to come close to this mark, with an average of around 17 percent.

About the methodology of the link study

- Population: Swiss resident population aged 15 to 79 years

- Total sample size: n= approx. 52,000

- Around 250 interviews per brand per calendar week and brand segment; for this annual review, rolling moving averages were formed over the last four calendar weeks in each case, i.e. approx. n=1,000 per data point and brand

- Confidence interval for total sample: max. +/- 3.1 percent (for 50% distribution).

- Research method: online interviews

- Quotation/weighting: by age, gender and region (interlocked)

- Random samples from the Link online panel, 100 percent of which is actively recruited through representative telephone surveys, reaching more than 97 percent of the relevant population; survey participants are excluded from follow-up surveys for at least three months at a time

- Survey period: 1.1.2022 to 31.12.2022