Energy transition and security of supply: double challenge for power generators

The consulting firm Colombus Consulting has published the 7th edition of its annual study on the financial health of European electricity producers. This notes a decline in electricity consumption, which continues to intensify in Europe (EU, UK and CH). In early 2023, despite a decline in electricity consumption at the beginning of winter, the geopolitical context continues to create tensions in [...]

The consulting firm Colombus Consulting has published the 7th edition of its annual study on the financial health of European electricity producers. This notes a decline in electricity consumption, which continues to intensify in Europe (EU, UK and CH). At the beginning of 2023, the geopolitical context continues to create tensions in energy supply, despite a decrease in electricity consumption at the beginning of winter. Against this backdrop, power producers continue to invest in renewables to diversify their supply sources.

Dramatic revenue growth for power generators in 2022

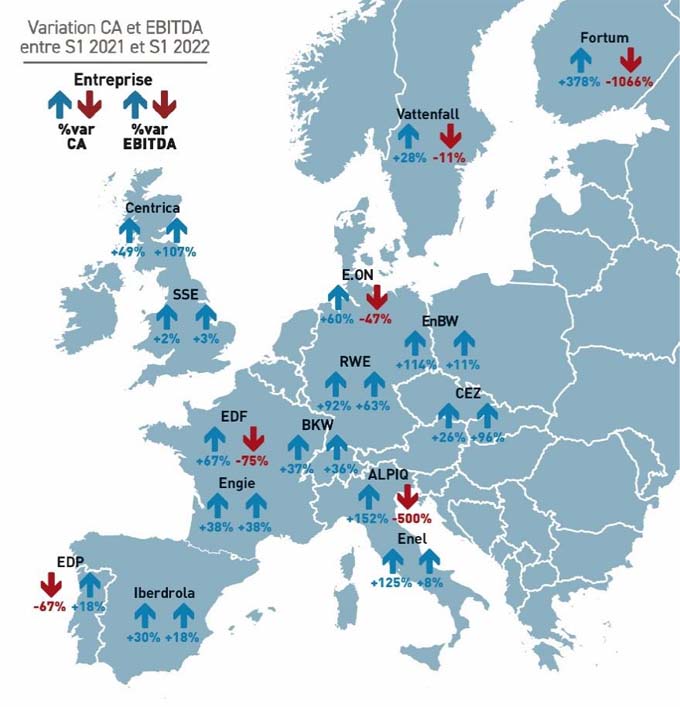

"The cumulative turnover of energy suppliers increased by 88 % between 2021 and 2022. This increase is almost ten times higher than that between 2020 and 2021. Profitability, on the other hand, does not follow the same trend," says Samy Belaiba, Energy Consultant at Colombus Consulting. In fact, the cumulative EBITDA of energy suppliers (excluding Fortum) fell by 11 % in the first half of 2022.

This finding applies to all energy suppliers, even if this growth masks major differences. Nine energy suppliers nevertheless perform better on this indicator in 2021, which shows that the other five players analyzed suffered significant losses in 2021. "Alpiq and BKW recorded an increase in turnover thanks to higher prices on the energy markets," adds Samy Belaiba. Valuation adjustments in financial hedging transactions have a strong impact on Alpiq's EBITDA (see chart).

Price fluctuations that benefit neither the producer nor the consumer

The very high volatility of electricity prices that has been observed in recent years does not benefit consumers or producers. Stabilizing the market is a complex equation and Member States have considered several strategies to mitigate the impact of the sudden price increase: Capping the price of gas, funding non-targeted price shields and/or targeted price schemes, opting for the single buyer system, taxing super profits.

The study also concludes that Switzerland's security of supply depends on successfully linking the use of carbon-free production methods. "The current pace of expansion of photovoltaics and wind energy in particular is not sufficient to meet the ambitions described in the Energy Future 2050 plan. The electricity demand resulting from the replacement of fossil fuels in transportation and heat generation will increase by at least 25%, adds Samy Belaiba.

Photovoltaic production, which has increased significantly compared to the previous year, now covers 6.3 % of Swiss demand, although voices are being raised in favor of preserving green spaces. For its part, the development of wind energy is slowing down. Some projects that were started 20 years ago are still awaiting approval from the federal government or the cantons. The stakes are high, as this equates to a cumulative estimated annual production of 493 GWh, in addition to the 1.2 TWh that are in the early stages of the process or planning. "Geothermal energy also has a role to play. It could generate 2 TWh of electricity per year in 2050, but the exploration of suitable sites takes time," concludes Samy Belaiba.

Source: Colombus Consulting

This article originally appeared on m-q.ch - https://www.m-q.ch/de/energiewandel-und-versorgungssicherheit-stromerzeuger-doppelt-gefordert/