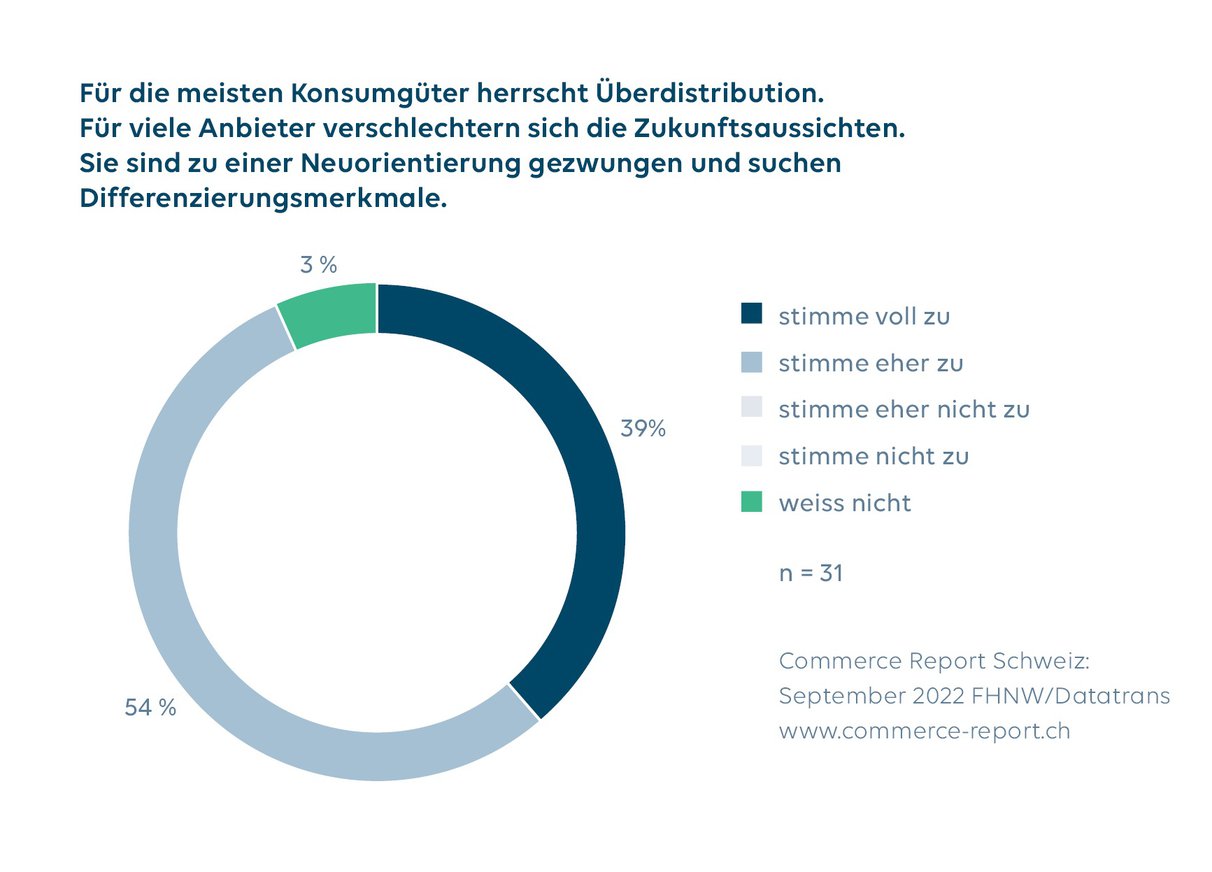

Massive oversupply of buying opportunities forces retailers to rethink

Now providers are desperately seeking differentiation. The increased value orientation of customers and a great openness to services provide starting points. Overall, online retail expects a 50 percent increase in sales by 2030. "Twenty-five brick-and-mortar stores with the same range of products distributed throughout Switzerland make sense. 25 identical online stores, on the other hand, do not. If the same product [...]

Now providers are desperately seeking differentiation. The increased value orientation of customers and a great openness to services provide starting points. Overall, online retail expects sales to increase by 50 percent by 2030.

"25 brick-and-mortar stores with the same product range spread across the whole of Switzerland make sense. But 25 identical online stores do not. If the same product is for sale in too many places, it's all about price," says study leader Prof. Ralf Wölfle, summarizing his survey results. "When it comes to price, however, only the biggest providers can keep up. That's why retailers now want to create attractive added value for their customers that goes beyond the interchangeable product."

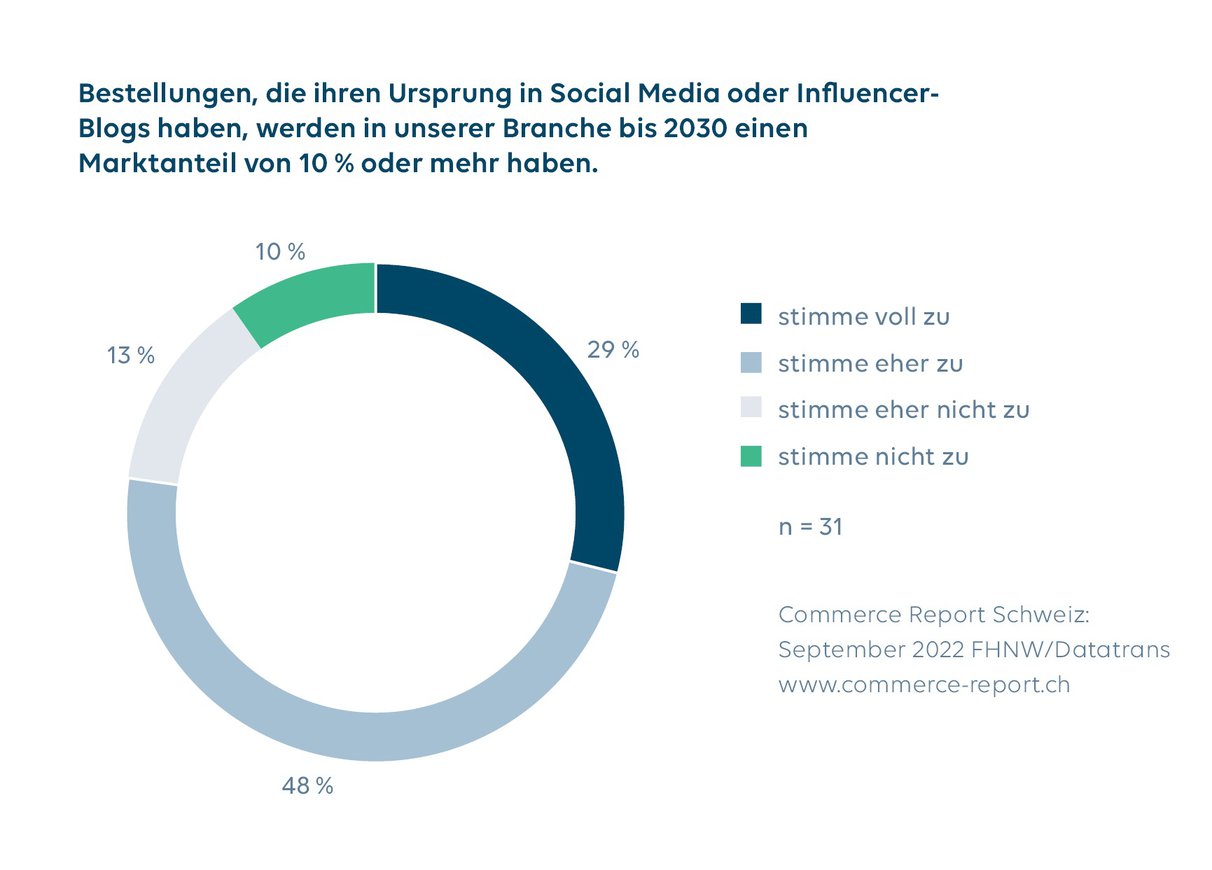

Increasing diversity of offerings also due to social media

As retailers differentiate themselves through value and services, the variety of offerings is also set to increase further. Direct sales from brands to end customers and increasing sales via social media channels are playing into this development. Compared to conventional online marketplaces, social media is becoming increasingly important because value-oriented offers can be better conveyed there.

Great service readiness in Quick Commerce

Online delivery services score points with a high level of service readiness. They benefit from the fact that almost half of all supermarket purchases are unplanned. If something is forgotten spontaneously, customers don't want to rush to the store again, but simply have the products delivered. With the fastest Zurich provider, this can be done in less than 15 minutes. The tests by various supermarket chains to deliver directly from the store are another example of emerging segments in food e-commerce.

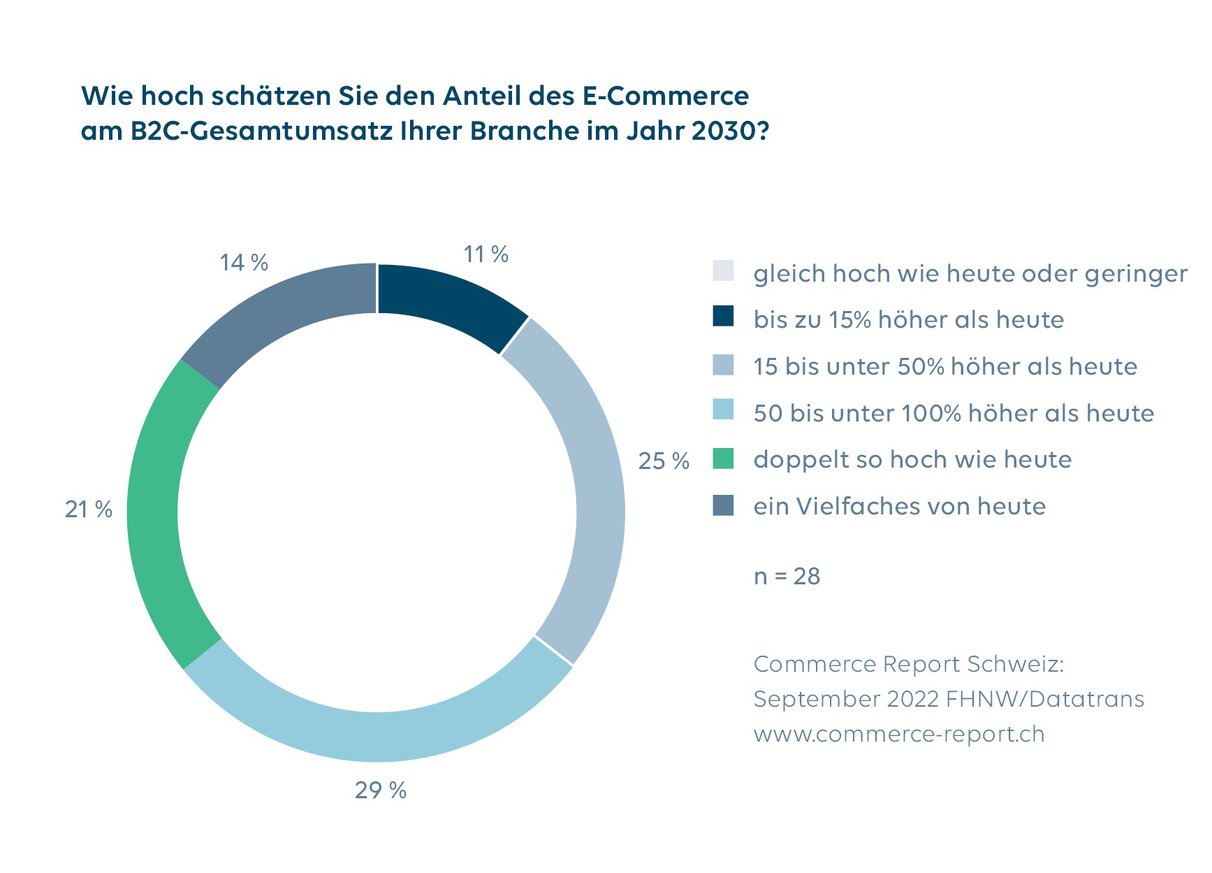

E-commerce sales to grow by 50 percent

Despite the rediscovery of stationary retail after Corona, online growth remains unbroken according to study participants: Two-thirds expect e-commerce sales in their industry to have increased by 50 percent or more by 2030. According to the participants, the trends that will have the greatest impact on the industry in the coming years are sustainability and upheavals in logistics.

Retailers and brands in a relationship crisis

What is currently preoccupying brands and retailers is a creeping conflict: Since stores have been closed due to the lockdowns, established brands have been pushing their direct sales to end consumers. Retailers feel increasingly competitive from their suppliers. Brands, in turn, complain that they do not represent retailers well enough and that they do not get enough data on customer behavior. The positions are deadlocked - even if retailers and brands will continue to need each other in the future.

More information at commerce-report.ch